Apple, one of the world’s most valuable tech giants, recently faced a significant blow to its financial health, with the company losing almost $200 billion in market value in just two days. This drastic downturn is attributed to China’s decision to ban iPhones, especially in government agencies and entities. Apple, gearing up to unveil its iPhone 15 series in the coming days, faces an uncertain future in one of the world’s largest consumer markets due to this ban. In this article, we will delve into the implications of China’s iPhone ban and its impact on Apple’s stock.

China’s iPhone Ban: A Major Setback

The recent turmoil began when China expressed concerns about foreign technology companies, suspecting them of mishandling sensitive domestic data. In response to these concerns, the Chinese government took swift action, instituting a ban on the use of foreign-branded smartphones, including iPhones, within government organizations. This move effectively means that Chinese government officials will no longer be permitted to carry or use iPhone devices.

China Mobile’s Refusal to Sell iPhone 15

To compound Apple’s woes in China, China Mobile, one of the country’s largest wireless communication operators, decided not to offer the iPhone 15 to its customers. This decision further exacerbates the tech giant’s struggle to maintain its foothold in the Chinese smartphone market, which is critical to its global business strategy.

Apple’s Stock Plunge

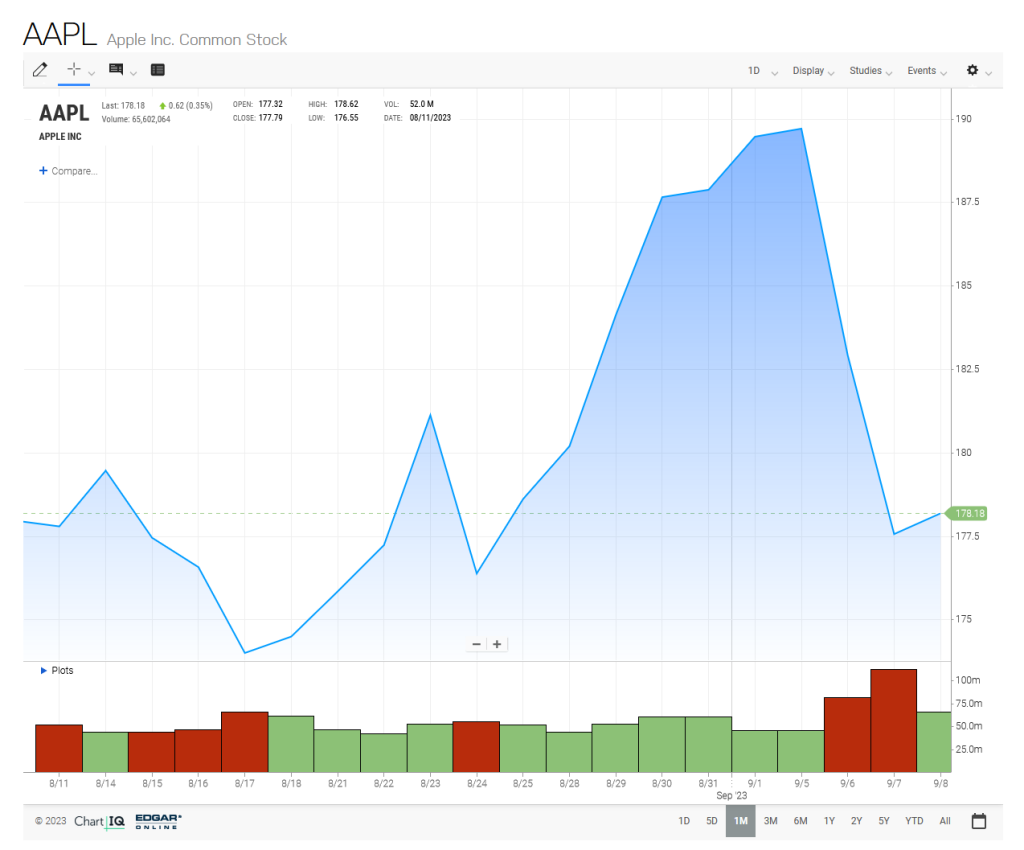

The repercussions of these developments were swift and severe. Apple’s stock price plummeted by over 5% in a single day, resulting in a staggering $191 billion loss in market capitalization within just two days. This drastic decline underscored the immediate and substantial impact of China’s iPhone ban on Apple’s financial standing.

European Regulatory Challenges

China is not the only challenge Apple is currently grappling with. In Europe, the European Union (EU) has raised concerns about the excessive market power held by certain tech giants, including Apple. The EU believes that these companies, including Apple, have led to monopolistic practices and data privacy concerns. As a result, the European Commission is planning to impose stricter rules and regulations on data usage by companies like Apple, potentially affecting their operations and bottom line.

U.S.-China Economic Tensions

The ban on iPhones in China is yet another sign of the escalating economic tensions between the United States and China. Both nations have been taking measures to restrict the activities of technology companies within their borders. Previously, the U.S. banned the popular Chinese-owned app TikTok from federal government devices due to concerns over data privacy and national security.

Long-Term Outlook and Wall Street Analysts

Despite the recent setbacks, many Wall Street analysts remain optimistic about Apple’s long-term prospects. They believe that events such as the upcoming iPhone 15 launch will have a positive impact on the company’s stock. Additionally, Apple’s strong brand loyalty, diversified product lineup, and loyal customer base provide a solid foundation for weathering these challenges.

Conclusion

The ban on iPhones in China, coupled with regulatory challenges in Europe and ongoing U.S.-China economic tensions, has put Apple in a precarious position. However, the tech giant’s resilience, innovation, and strong product offerings suggest that it may overcome these obstacles in the long run. As the global technology landscape continues to evolve, Apple’s ability to adapt and thrive in an ever-changing environment will be closely watched by investors and industry observers alike.